Here are the results of the OUTFRONT 2Q 2022 earnings release, investor deck and conference call.

Here are the results of the OUTFRONT 2Q 2022 earnings release, investor deck and conference call.

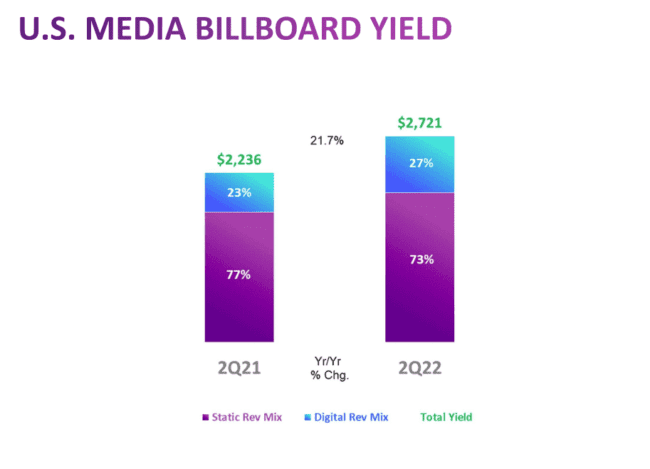

- Revenues increased 32% to $450 million for the quarter. US billboard yields grew 23% to $2,700 during the quarter due to rate increases.

Cashflow (adjusted OIBDA) increased by 70% to $125 million.

Cashflow (adjusted OIBDA) increased by 70% to $125 million.- Capital expenditures totaled $25 million including $7 million maintenance and $18 million to convert 37 static billboards to digital and acquire 60 digital units in Canada and Portland. OUTFRONT had 1,770 digital billboards as of June 30, 2022.

- OUTFRONT completed $239 million of acquisitions in the second quarter including the purchase of 950 faces for $185 million from Pacific Outdoor in Portland.

- Debt totaled $2.6 billion at June 30, 2022. The weighted average cost of debt is 4.6%. Leverage (net debt/cashflow) is a moderate 4.9 times. 23% of debt is floating.

Jeremy Male predicts 20% revenue growth in the third quarter

Looking specifically to Q3, we expect that we’ll have another good quarter. Based on our trends as today, with the vast majority of the quarter already booked, we currently estimate that Q3 total revenues will grow in the low teens percentage range with transit up about 20% versus last year.

Jeremy Male on the M&A market

We have a very full pipeline of deals we’ve agreed and we’re in due diligence and even some that we haven’t reached to an agreement yet, but continue to have discussions. So we think we’ll be active in the second half. No promises that there’ll be anything the size of Portland, but we have interest really in filling out our footprint. And there’s no lack of interested sellers.

[wpforms id=”9787″]

Paid Advertisement

Cashflow (adjusted OIBDA) increased by 70% to $125 million.

Cashflow (adjusted OIBDA) increased by 70% to $125 million.