Landmark Infrastructure revenues and cashflow increased sharply but the company did not add any new out of home advertising lease or easements. Here’s a summary of the Landmark 1Q 2021 financial release and conference call.

Landmark Infrastructure revenues and cashflow increased sharply but the company did not add any new out of home advertising lease or easements. Here’s a summary of the Landmark 1Q 2021 financial release and conference call.

- Revenue increased 25% to $17 million during the first quarter of 2021 due to acquisitions during the second half of 2020.

- EBIDTA increased from $7.1 million during the first quarter of 2020 to $15.5 million for the first quarter of 2021.

- Landmark made no new out of home lease or easement acquisitions during the first quarter of 2020. The company ended the quarter with 886 out of home advertising leases and easements at 625 different locations. The leases have an average remaining life of 14.9 years and average monthly rent of $1,950.

- Out of home leases and easements account for 42% of the company’s total portfolio of 2062 wireless communications, digital infrastructure, out of home and renewable power leases and easements as of March 31, 2021.

- The company installed 89 Dart digital kiosks in the first quarter of 2021 for a total installed base of 201. Landmark has a contract to deploy 300 digital kiosks throughout the Dallas Area Rapid Transit system. The kiosks will be supported by advertising.

CEO Tim Brazy says the out of home portfolio is improving

Our outdoor advertising segment which had been the segment most impacted by the pandemic continues to show improvement. After two quarters of sequential decline in our outdoor advertising segment revenues beginning in the second quarter of 2020 we’ve seen higher revenue in of the last two quarters…The outdoor advertising industry has been in the recovery phase since it reached the lowest level of outdoor advertising activity in…last year’s second quarter…If outdoor advertising activities rebound Landmark stands to benefit from higher rental revenues through contractual escalators and percentage rent provisions. We are increasingly optimistic that the worst is behind us for the outdoor advertising segment…

CFO George Doyle says don’t expect many acquisitions

On the acquisitions side I expect it to be somewhat limited near term. We want to focus on deploying the capital that we have today on the development activity. If there are opportunities we may pursue them on the data center side of things. We think that area provides the most attractive risk adjusted returns…

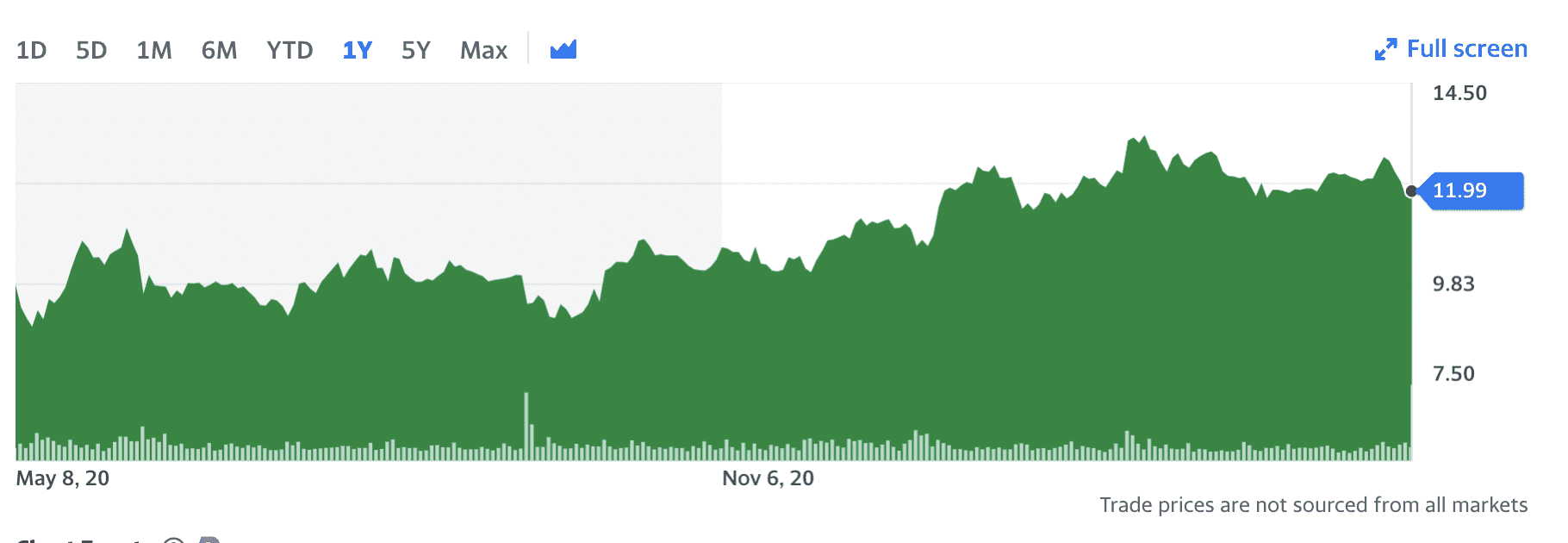

Insider’s take: Landmark is pivoting from ownership of out of home assets to owning data kiosks and wireless, green energy and data center leases. You can see from the chart below that Landmark has been slowly recovering from the impacts of covid.

Landmark Infrastructure Stock Performance Over Past Year

[wpforms id=”9787″]

Paid Advertisement