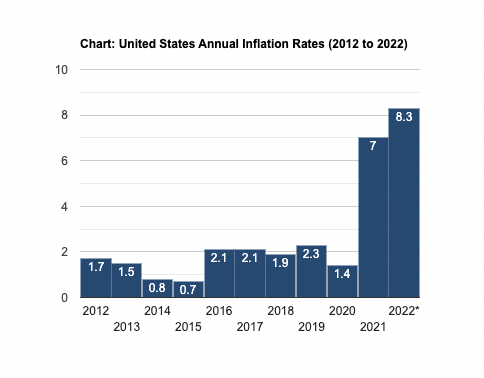

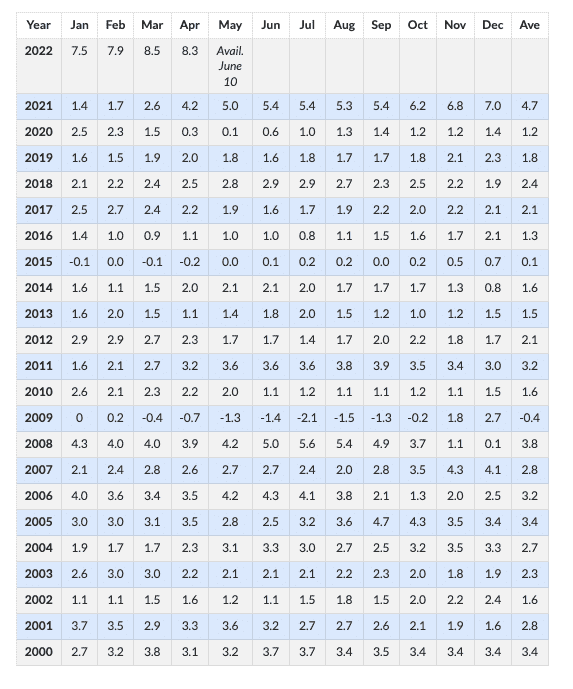

Inflation has increased from 1.5-2% annually to 7-8% annually. Take a look at this chart.

Source: US Inflation Calculator

When you drill down into the numbers you can see that inflation picked up in the last half of 2021 when the last round of covid stimulus vastly expanded the money supply during a recovering economy.

What does this mean for your out of home company?

Your input costs have gone up. Vinyl costs have increased. Digital billboard costs have increased. Employee costs are up. You need to ask clients for contract increases or your margins will erode. This was a common theme on the last round of out of home investor calls.

OUTFRONT CEO Jeremy Male at the May 24 JP Morgan Global Tech, Media and Communications Conference

Our yields were up 20-ish percent…A majority of that is price…We still have relatively low CPM’s compared to the other media out there. I think there’s significant opportunity to drive rate. The vast majority of our sales force haven’t been through an inflationary environment. So we’re almost having to do inflation 101…it’s fine to go after 7-8%.

Lamar CEO Sean Reilly on Lamar’s 1st quarter 2021 earnings call:

The last time we were able to see these kind of rate increases was the mid-2000’s. And we haven’t been able to talk about rate since the great recession. And we’ve been living in a 2% world…When haven’t been able to talk about rate for a decade. When we sit down and talk to our customers now they expect it. They expect the ask. And we’re asking.

[wpforms id=”9787″]

Paid Advertisement