US out of home stocks beat the market during the second quarter of 2021. Clear Channel Outdoor increased by 40% during the second quarter of 2021 versus a 7% increase for the Standard and Poor 500. Clear Channel stock is more volatile than the other out of home companies because it has more debt and financial risk. It goes up the most on good news and down the most on bad news. Maybe the stock market expects that Clear Channel’s sales are on the mend after taking longer to recover from covid than Lamar or OUTFRONT.

Outfront and Lamar each grew by 10% during the second quarter of 2021 versus a 7% increase for the Standard and Poors 500.

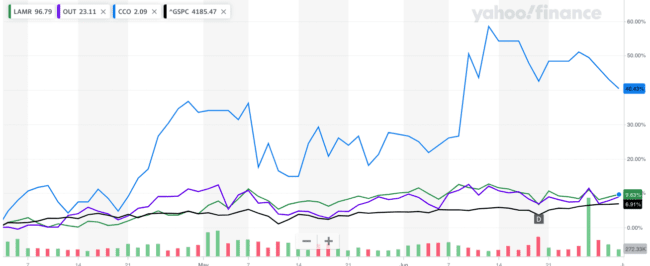

Stock performance for Lamar (green), OUTFRONT (purple) and Clear Channel Outdoor (blue) versus Standard and Poors 500 (black) for 3 mos ended June 30, 2021

Remember March 2020 when it was fashionable to show pictures of empty streets and planes crashing behind billboards…It was a once in a lifetime buying opportunity. If you kept your cool and purchased out of home stocks you made a fortune. Look at how the public out of home stocks have done since then.

Clear Channel Outdoor up 389%

OUTFRONT Media up 198%

Lamar Advertising up 161%

S&P 500 up 86%

Stock performance for Lamar (green), OUTFRONT (purple), Clear Channel Outdoor (blue) and the S&P 500 (black) since March 23, 2020.

[wpforms id=”9787″]

Paid Advertisement