Here are 5 things about Link Media Outdoor which Billboard Insider learned after reading 2020 10k for Link Media’s parent Boston Omaha.

Here are 5 things about Link Media Outdoor which Billboard Insider learned after reading 2020 10k for Link Media’s parent Boston Omaha.

This stock is capital gains, not current income.

Link Media’s parent Boston Omaha doesn’t intend to become a REIT or pay dividends any time soon. It want to reinvest cash to grow. The prospectus is clear: “We have never declared or paid any cash dividends on our capital stock. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. We do not intend to pay any cash dividends to the holders of our common stock in the forseeable future…”

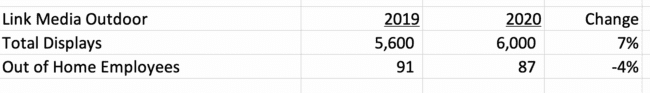

Link Media Outdoor is growing

Link Media grew total billboard faces by 7% in 2020, unlike the other public out of home companies where faces shrank by approx 5%. Out of Home employees dropped by 4% in 2020 but Link Media is looking to add employees now (see Link Media help wanted ads in the Billboard Insider classifieds).

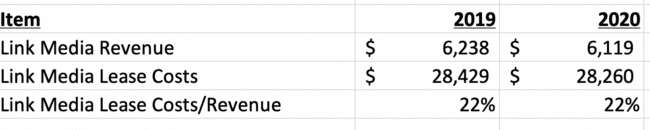

Limited Covid impact on revenue.

Link Media revenue declined by only 0.6% during 2020 due because new revenues from acquisitions offset a covid based decline in revenues. After adjusting for acquisitions it looks like Link Media’s organic revenues declined less than 5% in 2020 which compares favorably to the revenue declines at Lamar (down 11%), OUTFRONT (down 31%) and Clear Channel Outdoor (down 31%). There are benefits to having a mostly rural and small market plant with limited digital screen exposure.

Expect more acquisitions.

Link Media has closed 18 acquisitions, several assets purchases and 1 asset exchange since 2015. Expect more acquisitions. Page 1 of the 10k says: “One of our principal business objectives is to continue to acquire additional billboard assets through acquisitions of existing billboard businesses in the United States when they can be made at what we believe to be attractive prices…” Link Media’s parent Boston Omaha has a nice war-chest: $82 million in cash and treasuries; $17 million in availability under a Link Media bank line; and an estimated $90 million in incoming cash from a pending Boston Omaha 3.15 million share offering. Proceeds from the share offering are for Link Media billboard acquisitions and expansion of Boston Omaha’s broadband business.

Reasonable lease costs.

Link Media’s lease costs were a moderate 22% of revenues during 2020. Billboard Insider considers 20% of revenues normal for a roadside out of home plant.

[wpforms id=”9787″]

Paid Advertisement